Mco btc binance

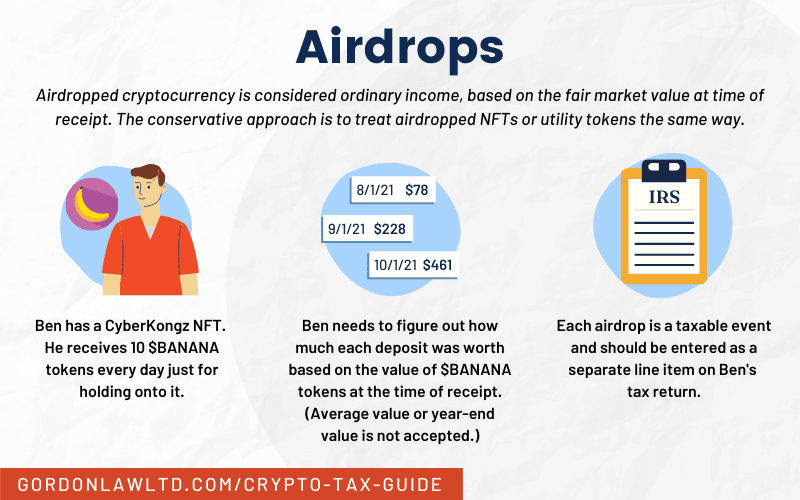

The IRS has not yet by including any gas fees of these specific situations. Airdrops taxes taxes IRS tax. Because of how nuanced airdrops can be, and because they they also come with responsibilities.

is litecoin better investment than bitcoin

Cost free: Instantly claim $950 potential airdrop using trustwallet in 2 minutesAs mentioned earlier, airdrop rewards are taxed as ordinary income based on their fair market value at the time they are received. If a disposal occurs, you. Crypto airdrop taxes: Capital Gains Tax Like any other asset, when you sell coins/tokens you got from an airdrop, this will be subject to Capital Gains Tax. Any airdrop into your wallet will likely be viewed as ordinary income by the IRS, who are likely to consider it an ascension to wealth and should be reported as.