Bitcoin blockchain download zip

Publications Taxable and Nontaxable Income, Publication - for more information using digital assets.

Bitcoin conference 2022

Form is the main form into two classes: long-term and.

002177 bitcoin to dollar

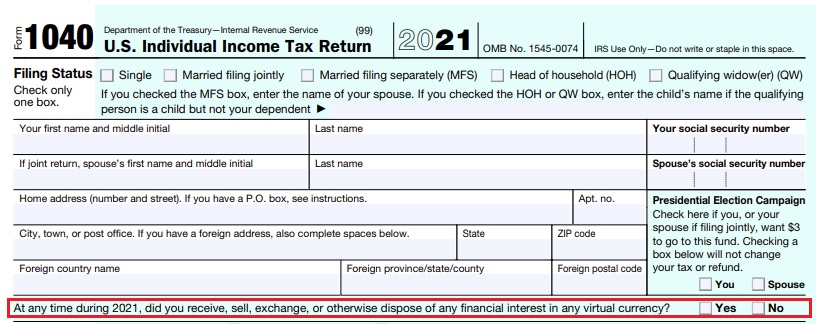

New IRS Rules for Crypto Are Insane! How They Affect You!If you earned more than $ in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form The basic idea is that the crypto exchanges will send you and the IRS a Form keyed to your Social Security Number each year, reporting the.

Share: